#bAhead! Integrated insights with GfK tech-enabled data analytics

Dear Readers,

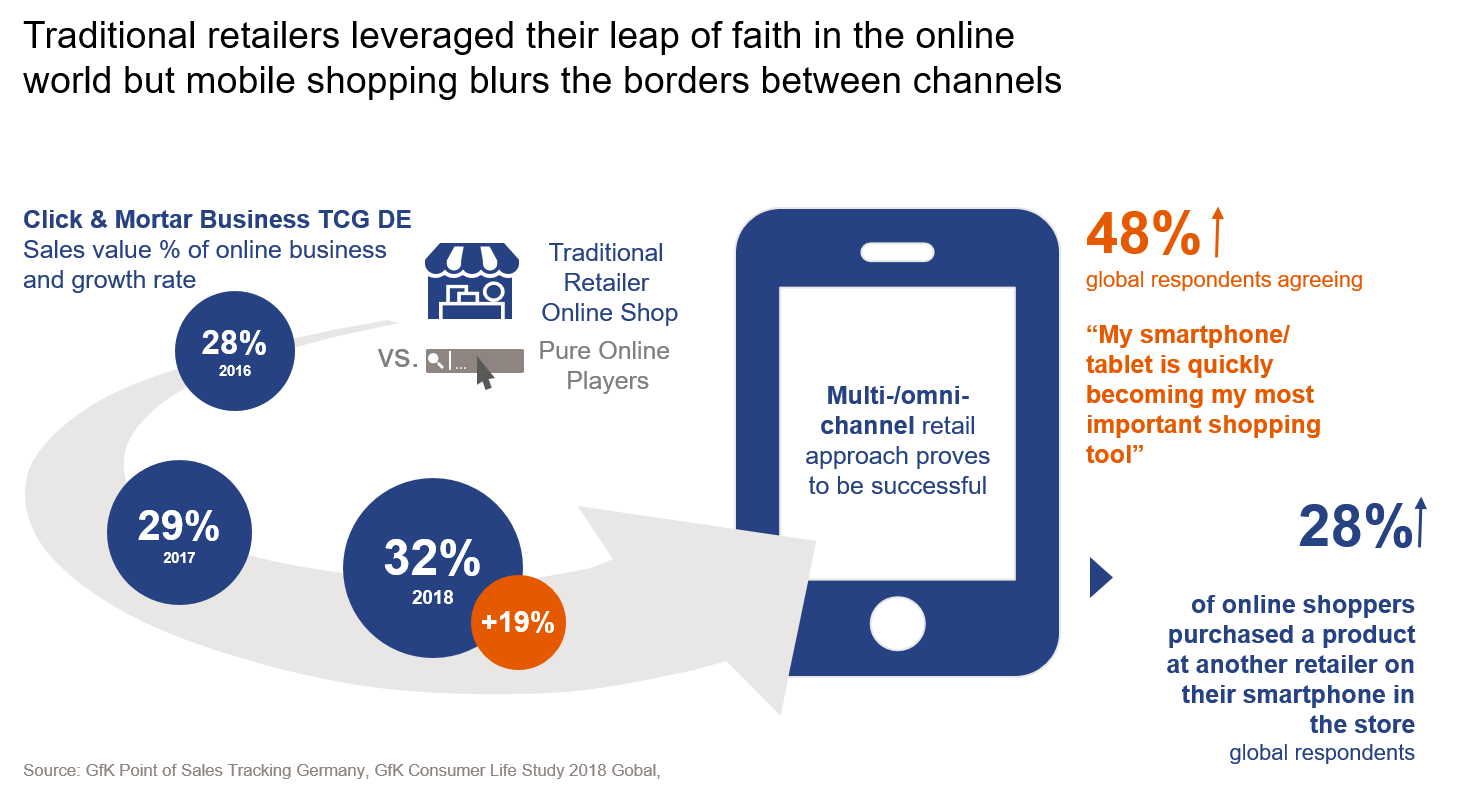

Industries and business models are being disrupted by digitization and consumer behaviour is changing at an incredible speed. Technology is at the core of everybody’s life, which leads to an almost endless amount of data that needs to be managed. But what is the value of this influx of data and how can you make use of it? Just as important: How fast can you draw insights and conclusions from this data to build and develop your brand? How can you “bAhead”?

We say: The right knowledge is key and it needs to adapt extremely fast to an ever-changing environment! This includes meaningful insights that allow you to make the right business decisions and succeed in highly competitive markets. The value of knowledge is beyond providing descriptive data. It is about integrative prescriptive analytics and recommendations.

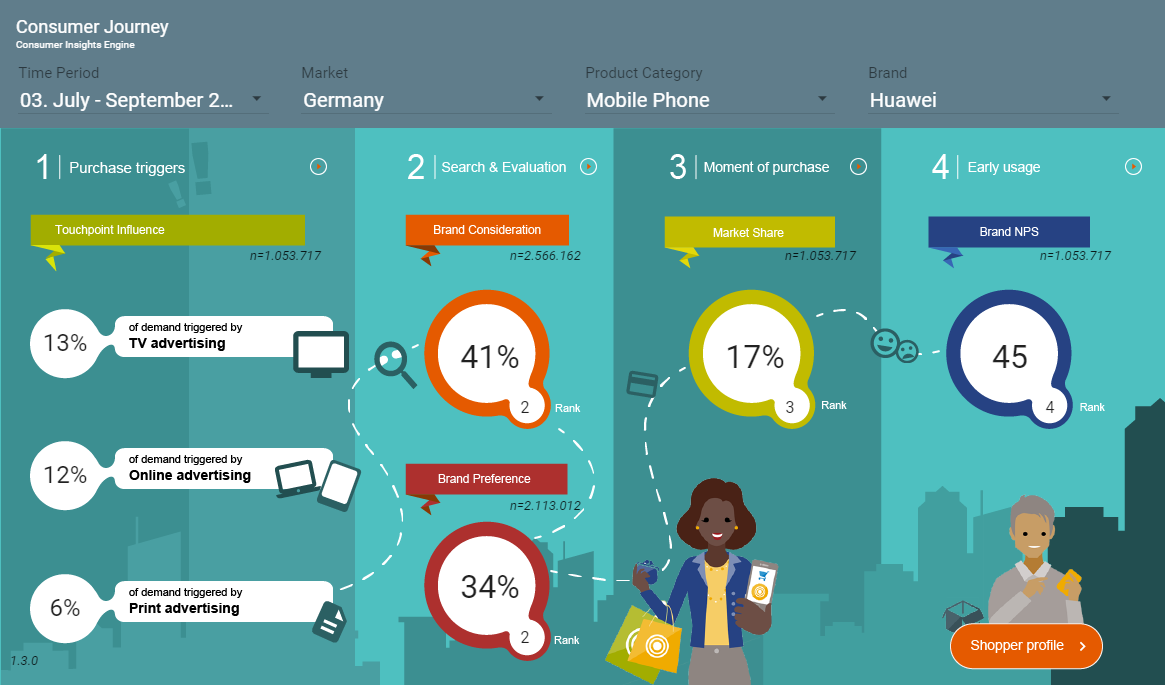

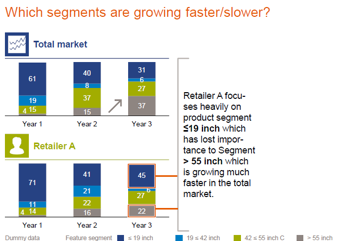

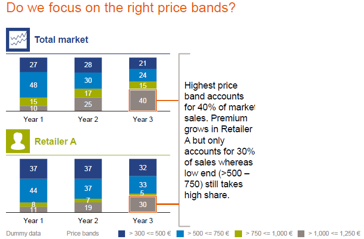

The value of knowledge was also at the center of this year’s GfK Insight Summit, our key client event in Germany. Together with speakers from Huawei, Philipp Morris, Vodafone, L’Oréal and innosabi, our experts presented to around 200 guests how our new automated GfK end-to-end platforms and advanced analytics help to answer their key business questions. “I didn’t know GfK could do that!” and “Absolutely inspiring and fascinating!” are just two of the most common reactions that certainly refer to our new data analytics tools and solutions.

For your reference, our expert speakers have wrapped up the key messages of their presentations in short articles for this eJournal. I hope you are enjoying these contributions.

Would you like to learn more? Please contact our experts directly.